When people think of banking, big national banks often come to mind. But regional banks offer a strong alternative with competitive rates, lower fees, and a more personal touch. Many of them focus on supporting local businesses and communities, making them a great option for those who want a bank that feels more connected to their area.

Unlike national banks that spread their services across the country, regional banks operate within a specific area, allowing them to cater to local financial needs more effectively. Many offer better interest rates on savings and lower loan rates, while still providing online and mobile banking features that make managing money easy.

If you’re looking for a bank that prioritizes customer relationships, community involvement, and solid financial products, regional banks may be the right fit.

25 Best Regional Banks of 2026

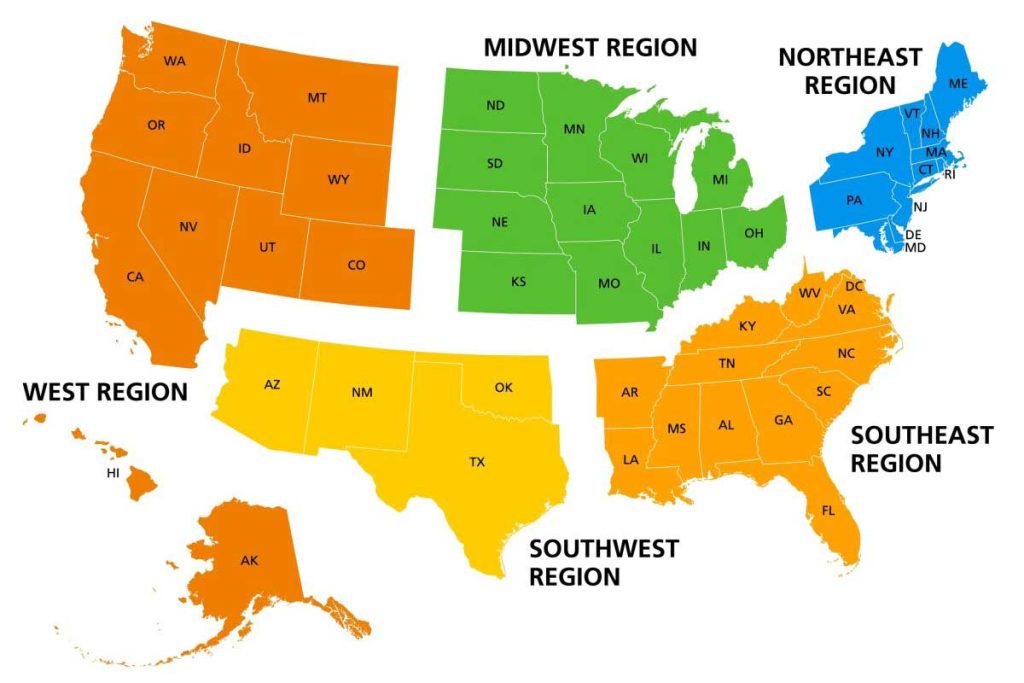

As you consider your options, we have curated a list of the top regional banks in various regions across the United States, highlighting their standout features to help you make an informed decision.

This list is a great place to start if you’re looking for a new place to do your banking, or simply want to compare your current bank to others in your area.

Best Regional Banks in the West

Regional banks in the West provide personalized service, competitive rates, and strong digital banking options. Whether you need a checking account, high-yield savings, or business banking, these banks offer solid choices.

Columbia Bank

Columbia Bank has locations across Oregon, Washington, California, Idaho, and Nevada. It offers checking, savings, and money market accounts with low opening deposit requirements and no hidden fees.

The bank’s Go-To mobile app connects customers directly with a banker for quick answers and financial advice. Columbia also provides small business and commercial banking solutions, making it a strong choice for entrepreneurs.

East West Bank

East West Bank serves customers in California, Washington and other states, offering checking, savings, and loan options for individuals and businesses. It provides competitive rates on deposit accounts and flexible lending options for homebuyers and business owners.

Its online and mobile banking platforms make managing money easy, with features like mobile check deposit, bill pay, and account transfers. Businesses also benefit from specialized financial services, including commercial lending and treasury management.

First Interstate Bank

First Interstate Bank operates in Montana, Oregon, South Dakota, Wyoming, and several other states. It offers full-service banking with a community-focused approach, including free and interest-bearing checking accounts, competitive savings rates, and loan programs.

Customers can access in-person banking through its wide branch network, or use its online tools for mobile check deposits and transfers. The bank also provides mortgage and business lending options with flexible terms.

Zions Bank

Zions Bank serves customers in Utah and Idaho with personal and business banking solutions, including checking, savings, and money market accounts. It offers competitive mortgage and small business loan programs, along with various CD options.

Online and mobile banking features allow customers to pay bills, deposit checks, and manage finances from anywhere. With a long-standing reputation in the region, Zions Bank is a reliable choice for those looking for a mix of modern banking and local service.

Best Regional Banks in the Southwest

Southwest regional banks offer a mix of strong customer service, competitive interest rates, and a focus on local communities. Whether you’re looking for everyday banking, business solutions, or investment opportunities, these banks stand out.

BOK Financial

BOK Financial is the largest bank in Oklahoma, with branches in Texas, New Mexico, and other states. It offers a full range of banking services, including checking and savings accounts, money market options, and CDs with competitive rates.

Customers benefit from various loan products, including mortgages, personal loans, and business financing. The bank also provides investment and retirement planning services, making it a strong choice for those looking to grow their wealth.

First National Bank Texas

First National Bank Texas (FNBT) has over 300 locations across Texas, New Mexico, and Arizona. It offers flexible checking and savings accounts with low opening deposit requirements and no hidden fees.

Customers can take advantage of its money market accounts, CDs, and loan programs for personal and business needs. FNBT’s widespread presence makes it a convenient option for those in the Southwest.

Frost Bank

Frost Bank is a Texas-based institution known for its excellent customer service and strong digital banking tools. With 171 branches and access to 1,700 ATMs, it provides easy banking solutions for customers throughout the state.

In addition to standard checking and savings accounts, Frost offers personal and business loans, investment options, and insurance services. Its focus on financial growth and stability makes it a great choice for Texans looking for a full-service bank.

MidFirst Bank

MidFirst Bank, headquartered in Oklahoma City, is the largest privately owned bank in the U.S. It operates in Oklahoma, Arizona, and Colorado, offering a mix of personal and business banking services.

Customers can choose from multiple checking account options, some of which allow monthly service fees to be waived. The bank also provides mortgage lending, investment accounts, and money market products, making it a flexible option for those who want a mix of convenience and financial growth.

Best Regional Banks in the Midwest

Midwest regional banks offer strong branch networks, competitive interest rates, and digital banking features. Whether you need a free checking account, a credit-building loan, or small business services, these banks provide solid options.

Arvest Bank

Arvest Bank operates in Arkansas, Kansas, Oklahoma, and Missouri, offering full-service banking with a focus on local customers. It provides checking, savings, money market accounts, and CDs with competitive rates.

Its highly rated mobile banking app makes managing accounts easy, allowing users to deposit checks, transfer funds, and pay bills on the go. While in-person banking is widely available, only residents of the four states it serves can open accounts online.

BMO Harris Bank

BMO Harris Bank has expanded significantly, now reaching 32 states after acquiring Bank of the West. It provides checking and savings accounts, credit builder loans, and mortgage options, catering to both individuals and businesses.

Customers benefit from fee-free access to over 40,000 ATMs nationwide through the Allpoint network. Its free checking account makes it a strong choice for those looking to avoid monthly fees.

Fifth Third Bank

Fifth Third Bank serves 11 states across the Midwest and beyond, with over 1,100 branches. It offers multiple checking and savings accounts, CDs with flexible terms, and personal and small business loans.

The Fifth Third Momentum Checking account has no monthly service fee and provides access to 50,000+ fee-free ATMs. Its well-rated mobile app allows for 24/7 account management, making banking more convenient.

Huntington National Bank

Huntington Bank has more than 1,100 branches across 12 states, providing full-service banking with a focus on customer-friendly features. It offers checking, savings, loans, and wealth management services.

One of its standout features is the 24-hour overdraft forgiveness program, which gives customers extra time to cover overdrafts before fees apply. It also offers a free checking account and strong digital banking tools for easy account access.

Best Regional Banks in the Southeast

Southeast regional banks offer strong customer service, competitive account options, and financial products tailored to both individuals and businesses. Whether you’re looking for everyday banking or investment solutions, these banks provide excellent options.

Cadence Bank

Cadence Bank operates in six states, including Mississippi, Alabama, and Texas, offering a full suite of personal and business banking services. Customers can choose from checking and savings accounts, credit cards, and mortgage options.

With a strong community focus, the bank provides flexible lending solutions, making it a great option for homebuyers and small business owners. Its online and mobile banking tools make managing finances easy from anywhere.

Hancock Whitney Bank

Hancock Whitney Bank serves the Gulf Coast region with branches in Louisiana, Mississippi, Alabama, Florida, and Texas. It offers checking and savings accounts with competitive rates, as well as personal and business lending options.

Known for its local expertise, the bank provides wealth management services and tailored financial guidance. Customers also benefit from flexible account options designed to fit different financial goals.

SouthState Bank

SouthState Bank, the largest regional bank in Florida, has over 240 branches across six states, including Virginia and South Carolina. It offers checking and savings accounts, investment products, and loan options for both individuals and businesses.

Customers can access digital banking tools for convenient account management. The bank’s strong lending programs make it a solid choice for homebuyers and business owners looking for financing solutions.

Synovus Bank

Synovus Bank operates in Georgia, Florida, Tennessee, and other Southeastern states, offering personal and business banking services. It provides free checking options, savings accounts, and investment solutions for customers at all financial levels.

With access to Publix Presto ATMs surcharge-free, customers can easily withdraw cash without extra fees. Synovus also offers financial planning and wealth management services, making it a good choice for long-term financial growth.

Best Regional Banks in the Northeast

Northeast regional banks offer strong digital banking options, competitive interest rates, and flexible checking accounts. Whether you need everyday banking, investment services, or business solutions, these banks provide reliable options.

Fulton Bank

Fulton Bank operates over 250 branches across Pennsylvania, Delaware, Maryland, New Jersey, and Virginia. It offers a full range of personal and business banking services, including checking, savings, money market accounts, and CDs.

Customers benefit from online and mobile banking features, along with a strong regional presence for in-person service. Its flexible account options make it a convenient choice for everyday banking needs.

M&T Bank

M&T Bank has a strong presence in New York, Connecticut, Maryland, Pennsylvania, and New Jersey, serving customers across 13 states. It offers checking and savings accounts, credit and debit cards, retirement accounts, and investment services.

Its basic checking account has no monthly fee, making it a cost-effective option for everyday banking. Customers can also access loans and financial planning services to support long-term financial goals.

Valley National Bank

Valley National Bank has 200 branches across multiple states, including New Jersey, Florida, and Illinois. It provides checking and savings accounts with options like Rewards Checking and Interest Checking to help customers earn more on their deposits.

With a focus on convenience, the bank offers strong online banking features and multiple account types to fit different financial goals. Customers can also access loan and mortgage products.

Webster Bank

Webster Bank serves customers in Massachusetts, New York, and other Northeastern states with a network of 177 branches. It offers checking, savings, money market accounts, and CDs, along with personal and business lending solutions.

The bank provides five checking account options, including an Opportunity Checking account designed for those looking for second-chance banking. Its commitment to accessibility and financial flexibility makes it a strong regional choice.

Top Regional Banks With National Reach

Some regional banks operate on a larger scale, offering services across multiple states while maintaining a focus on personalized banking. These banks provide a strong mix of in-person service, digital banking tools, and competitive account options.

U.S. Bank

U.S. Bank is the fifth-largest bank in the U.S., with over 2,000 branches in 26 states, primarily in the Midwest and West. Customers can access a vast ATM network, including MoneyPass ATMs, for fee-free withdrawals.

Accounts can be opened online or in person, and its highly rated mobile app allows for easy account management, bill payments, and mobile check deposits. The bank also offers personal and business loans, mortgages, and credit cards.

Citizens Bank

Citizens Bank operates over 1,000 branches across 11 states in New England, the Mid-Atlantic, and the Midwest. It offers a full suite of banking services, including checking and savings accounts, credit cards, and small business banking.

Customers can take advantage of online-only savings accounts and CDs with competitive rates and no monthly fees. The bank also provides personal lending and mortgage options, making it a well-rounded choice for long-term banking.

Regions Bank

Regions Bank has more than 1,500 branches across 15 states, primarily in the South and Midwest. It provides personal and business banking, loans, credit cards, and wealth management services.

Customers benefit from 24/7 phone support and digital banking tools for remote check deposits and easy account management. Its focus on modern banking solutions makes it a convenient option for those who prefer both online and in-person banking.

TD Bank

TD Bank operates along the East Coast, with 1,200 branches in 15 states. It offers various financial products, including checking and savings accounts, credit cards, and CDs.

Known for its customer-friendly approach, TD Bank locations have extended hours, including weekend service. Its digital banking features allow for easy access to accounts, bill payments, and mobile deposits.

Truist

Truist Bank serves 17 states and Washington, D.C., with over 2,100 branches. It provides a wide range of financial products, including checking and savings accounts, credit cards, and money market accounts.

With a strong online and mobile banking platform, customers can manage accounts, transfer funds, and deposit checks remotely. Its business banking services make it a solid option for entrepreneurs and larger companies.

How to Choose the Right Regional Bank

The right regional bank depends on your financial goals, location, and how you prefer to manage your money. Keep these factors in mind:

- Location and access – Choose a bank with branches or ATMs near your home or workplace. It’s helpful for cash deposits and in-person support.

- Fees and account costs – Watch for monthly fees, overdraft charges, and ATM fees. Many banks waive fees if you meet requirements like direct deposit or a minimum balance.

- Interest rates – Compare rates on savings, CDs, and loans. Higher deposit rates grow your savings faster. Lower loan rates mean less interest paid.

- Digital banking features – Look for mobile check deposit, bill pay, and transfers. A highly rated app makes it easier to manage your money on the go.

- Customer service – Read reviews to see how the bank handles support. Some offer 24/7 help by phone, live chat, or in person.

- Security and fraud protection – Make sure the bank offers two-factor authentication, alerts, and fraud monitoring. Quick resolution of issues is essential.

Frequently Asked Questions

What’s the difference between a regional bank and a community bank?

Regional banks are larger than community banks, with more branches, ATMs, and financial products. They often offer business lending, investment services, and digital banking tools across multiple states.

Community banks focus on local customers, providing a more personal banking experience. They specialize in deposit accounts, home loans, and small business lending, often prioritizing relationships over scale. Both offer strong customer service, but regional banks balance convenience with a community-focused approach.

What are some benefits of using a regional bank?

Regional banks often provide a more personal touch and in-depth local knowledge. Moreover, they are connected to the community and offer more flexible lending options. Furthermore, regional bank fees tend to be lower than bigger banks.

For those who prioritize low fees, online banks are another option to consider. These banks, also known as digital or online-only banks, have the lowest fees of all banking options, thanks to their lower overhead expenses. They pass the savings on to their customers.

Are there any downsides to using a regional bank?

Regional banks may have fewer branches and ATMs compared to big banks, which can be a disadvantage for some customers. Moreover, they may not offer as many types of accounts or financial products as large banks.

Can I open an account with a regional bank if I don’t live in the region they serve?

It depends on the bank’s policies. Some regional banks may require that you live in the region they serve to open a bank account, while others may be more flexible.

How many regional banks are there in the U.S.?

Based on the Federal Reserve Board’s definition of a regional bank, of $10 billion to $100 billion in assets, there are around 120 regional banks in the U.S.