Many small business owners struggle to secure funding, whether it’s for startup costs, equipment, or day-to-day operations. With traditional banks tightening lending requirements, online lenders have stepped in with easier applications and faster funding.

Finding the right loan can help cover expenses, expand operations, or manage cash flow. Some lenders focus on fast approvals, while others offer lower interest rates or more flexible repayment terms.

Top 6 Small Business Loans

Here’s a look at the best small business loan providers of 2025, each offering unique benefits depending on your needs.

1. Bluevine

Bluevine is a one-stop shop for all your lending needs. The company offers small business loans, lines of credit, and invoice factoring for up to $5 million. And unlike other lenders, Bluevine charges minimal fees.

Pros

- Our pick for Best for Invoice Factoring

- Invoice factoring for up to $5 million

- No origination, prepayment, or monthly maintenance fees

- Low credit requirements

Cons

- Minimum $10,000 in monthly sales to qualify for invoice factoring

- Invoice factoring fees quickly add up

- May not be available in every state

2. Lendio

Lendio is a lending marketplace, which means they don’t loan you any money. Instead, they match you with lenders that might be a good fit for your business.

So all you have to do is fill out a 15-minute application, and you’ll be able to compare offers from multiple lenders.

Pros

- Best Lending Marketplace

- Simple, straightforward application process

- You’ll gain access to multiple lending offers

- Will save you time shopping for lenders

Cons

- Some lenders have higher interest rates

- A possible hard inquiry on your credit report

3. Kabbage

With just one short application, you could receive up to $250,000 in funding from Kabbage from American Express.

You’ll need to have a business checking account or a PayPal account to apply. The company refers to these loans as lines of credit, but the repayment terms will be the same as a traditional business loan.

Pros

- Best for Fast, Convenient Loans

- Low annual revenue and credit requirements

- No origination fees

- Convenient access to funding

Cons

- Must have been in business for at least a year

- High APRs on loans

4. Fundbox

Instead of filling out an online application, Fundbox will connect to your bank account or accounting software. Then, using an algorithm, the company will determine whether they want to work with you.

Not only is the application process extremely quick, but Fundbox is an excellent option for borrowers with less-than-ideal credit scores.

Pros

- Best for Poor Credit

- Fast approval process

- Low credit requirements

- Quick funding

Cons

- Loans come with high APRs

- Loan amounts will be lower than what other lenders offer

5. Fundation

Fundation offers loans for up to $500,000 and lines of credit for up to $150,000. All of their loans come with flexible repayment terms and quick funding.

Pros

- Best for Flexible Repayment Terms

- Flexible repayment terms

- Low APRs

- Generous loan amounts

Cons

- Must have been in business for at least a year

- Must have at least three employees

- Minimum $100,000 in annual revenue

6. LendingClub

LendingClub is one of the largest peer-to-peer lenders on the market. The company offers competitive interest rates and flexible application requirements.

Pros

- Best for Low Annual Sales Requirements

- Offers loans up to $300,000

- Low fixed interest rates

Cons

- Borrowers must have a credit score of 640 or higher

- Must have been in business for at least a year

- High origination fees

Small Business Loan Options: Finding the Right Fit

Business loans come in different forms, each designed for specific needs. Choosing the right one depends on how much funding you need, how quickly you need it, and how you plan to repay it.

- Term Loans – A lump sum repaid over time. Good for major expenses like expansion or equipment.

- SBA Loans – Government-backed with lower rates. Best for established businesses that meet strict requirements.

- Business Line of Credit – Works like a credit card with flexible access to funds. Useful for managing cash flow.

- Equipment Loans – Funds equipment purchases, using the equipment as collateral.

- Merchant Cash Advances – Upfront cash repaid through a percentage of daily credit card sales.

- Invoice Financing – Uses unpaid invoices to get cash fast. Helps businesses waiting on customer payments.

- Working Capital Loans – Short-term funding for day-to-day expenses or seasonal slowdowns.

The right loan depends on your credit score, revenue, and whether you need a quick cash boost or long-term financing.

What to Consider Before Applying for a Small Business Loan

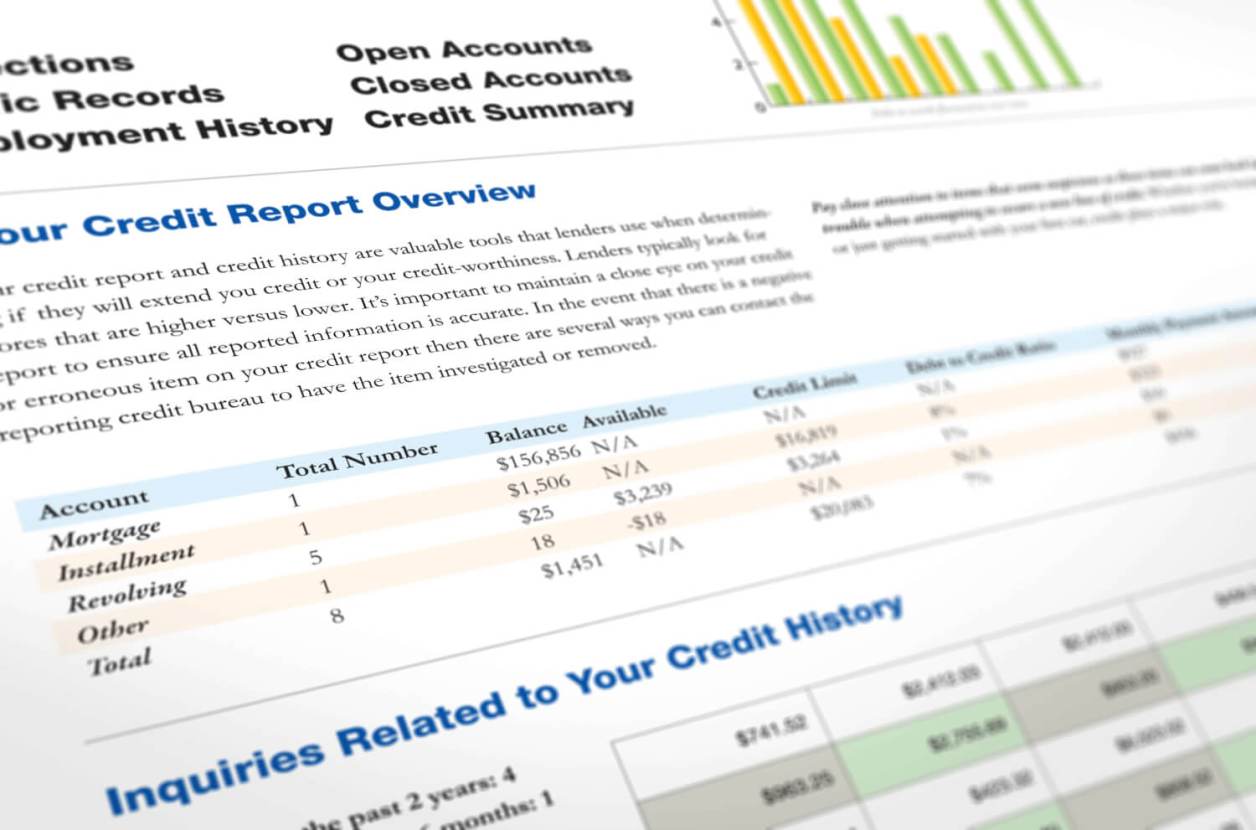

Getting approved for a small business loan depends on your financial health, credit history, and ability to repay. Before applying, focus on these key factors:

- Credit Score – Lenders check both personal and business credit. A higher score can mean better rates and loan terms.

- Business Plan – A clear plan shows lenders how you’ll use the funds and how your business will generate revenue to repay the loan.

- Loan Terms & Interest Rates – Compare repayment terms, interest rates, and fees to find the most affordable option.

- Revenue & Cash Flow – Steady income reassures lenders that you can handle loan payments.

- Collateral & Personal Guarantee – Some loans require collateral or a personal guarantee, putting business or personal assets at risk if you default.

- Lender Requirements – Each lender has different credit score and revenue minimums. Check these before applying to improve your chances of approval.

Being prepared helps speed up the application process and increases your odds of securing the best loan for your business.

Where to Get a Small Business Loan

Finding the right lender depends on your credit score, business history, and how quickly you need funding. Some lenders offer lower rates but stricter requirements, while others provide faster approvals at a higher cost.

Here’s a look at the three main types of lenders and what to expect from each:

Banks and Credit Unions

Traditional banks and credit unions offer the lowest interest rates and longest repayment terms, making them a great choice for established businesses with strong credit. However, they often require collateral, and the approval process can take weeks or even months.

SBA Loans

The U.S. Small Business Administration (SBA) backs loans through partner banks, making lenders more willing to approve applicants. These loans offer competitive rates and long repayment terms but have strict eligibility requirements and a slow approval process.

Online Lenders

Online lenders provide faster approvals and more flexible requirements than banks, making them a good option for newer businesses or those with lower credit scores. Some offer funding within 24 hours, but interest rates can be higher, so it’s important to compare lenders.

Choosing the right lender depends on whether you prioritize low costs, fast funding, or easier qualification.

How to Qualify for a Small Business Loan

Getting approved for a small business loan requires preparation. Follow these steps to improve your chances of securing the best terms:

1. Check Your Credit Score

Lenders review both personal and business credit scores to assess risk. A higher score can mean better rates and approval odds. If your score is low:

- Pay down existing debt.

- Make all payments on time.

- Dispute errors on your credit report.

2. Organize Your Financial Documents

Most lenders require proof that your business is financially stable. Gather these key documents before applying:

- Business and personal tax returns.

- Bank statements.

- Profit and loss statements.

- A business plan outlining revenue and repayment strategies.

3. Review Lender Requirements

Each lender has different minimums for credit scores, time in business, and annual revenue. Research these in advance to avoid unnecessary rejections.

4. Compare Loan Options

Different loans serve different needs. Consider:

- Term Loans – Best for large, one-time expenses.

- Lines of Credit – Great for managing cash flow.

- SBA Loans – Offer lower rates but take longer to secure.

- Online Lenders – Fast approvals but higher interest rates.

5. Apply with the Best Lender for Your Needs

Once you’ve identified the best option, complete the application with accurate details and submit all required documents. Some lenders may require a personal guarantee or collateral.

6. Prepare for Possible Rejection

If denied, ask the lender why. You may need to improve your credit, increase revenue, or explore alternative funding like business credit cards or grants.

By taking these steps, you can improve your chances of getting approved for a loan that fits your business needs.

Alternatives to Small Business Loans

A traditional business loan isn’t the only way to secure funding. Depending on your business stage and financial situation, one of these alternatives might be a better fit:

Business Grants

Grants provide free funding that doesn’t need to be repaid. They come from government agencies, private companies, and nonprofits.

- Pros: No repayment required; doesn’t reduce ownership.

- Cons: Highly competitive; strict eligibility rules; long application process.

Crowdfunding

Raise money through online platforms by attracting investors, customers, or supporters.

- Pros: No repayment; doubles as a marketing tool; builds community support.

- Cons: Requires strong promotion; may expose ideas to competitors; some platforms take a cut of funds raised.

Venture Capital

Investors provide funding in exchange for equity, typically for high-growth startups.

- Pros: Large funding potential; investors may offer business expertise.

- Cons: Requires giving up ownership; pressure for rapid growth; competitive application process.

Personal Savings

Using personal savings avoids debt but carries financial risk.

- Pros: Full control; no interest or loan payments.

- Cons: Risk of losing personal savings; may not be enough for larger expenses.

Business Credit Cards

A quick way to cover expenses while earning rewards, but interest can add up if not paid off quickly.

- Pros: Fast access to funds; potential cash back or rewards.

- Cons: High-interest rates if unpaid; can impact personal credit.

Personal Loans

Can be an option for newer businesses that don’t qualify for business loans.

- Pros: Available even with average credit; fixed interest rates.

- Cons: Personal liability; can affect personal credit; may not provide enough funding.

Choosing the right funding source depends on your business goals, risk tolerance, and ability to secure financing.

Final Thoughts

The best small business loan depends on your financial situation, how fast you need funding, and your long-term repayment ability. Banks and credit unions offer the lowest rates but have stricter requirements. Online lenders provide faster approvals with fewer restrictions but often charge higher interest.

If a traditional loan isn’t the right fit, alternative financing like grants, crowdfunding, or venture capital may be worth exploring. The key is to compare options carefully and choose what works best for your business.