A bank account is a cornerstone of personal finance management. Whether you’re depositing your paycheck, saving for a rainy day, or managing expenses, understanding the costs associated with opening and maintaining a bank account is essential.

This article will guide you through the types of bank accounts, typical fees, strategies for minimizing costs, and factors to consider when choosing a bank to help you make informed decisions.

Key Takeaways

- The costs of opening and maintaining a bank account vary based on account type, with common fees including monthly maintenance fees, overdraft fees, and ATM fees.

- Different types of accounts, such as checking, savings, money market accounts, and CDs, have unique fee structures and benefits, making it important to choose based on your financial needs.

- Minimizing bank account fees can be achieved by selecting banks with low or no fees, maintaining required balances, using in-network ATMs, and taking advantage of bank promotions and offers.

Types of Bank Accounts and Their Costs

Bank accounts vary widely in terms of features, purposes, and associated fees. The main types include checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). Each type caters to different financial needs, offering various benefits and fee structures.

Checking Account

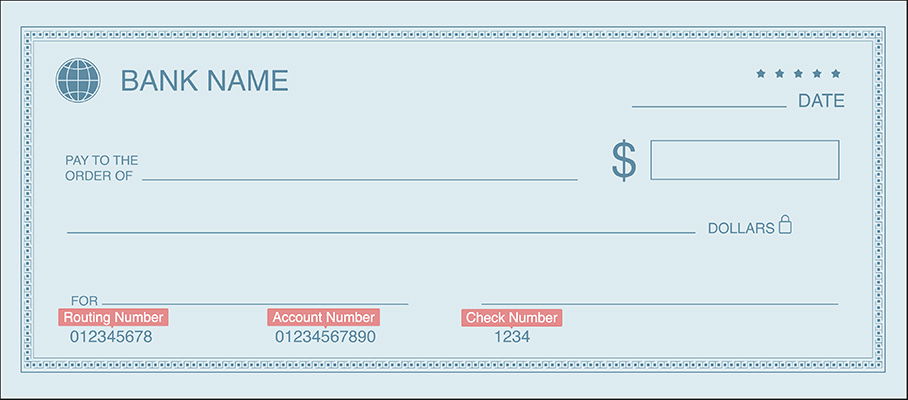

A checking account is for daily transactions, letting you deposit money, make withdrawals, pay bills, and access funds with a debit card or checks.

Common Checking Account Fees

Checking accounts often come with a few standard fees, which can vary depending on the bank and the specific account type.

Monthly Maintenance Fee

Checking accounts often come with a monthly maintenance fee, which is a fee charged by the bank for maintaining your account. The fee can range from $5 to $15 per month, depending on the bank or credit union and the specific account. Some banks offer tiered accounts, where higher-tier accounts have more features but also higher fees.

Your checking account may also require a minimum opening deposit to activate it once you’ve been approved.

Overdraft Fees

Overdraft fees are charged when you spend more money than you have in your checking account. These fees can be quite expensive, ranging from $25 to $35 per overdraft. Some banks offer overdraft protection, which links your checking account to another account, such as a savings account or credit card, to cover overdrafts and avoid fees. However, this service may come with its own fees.

ATM Fees

When using an ATM outside your bank’s network, you may be charged a fee by both the ATM owner and your financial institution. These fees can range from $2 to $5 per transaction. Some banks and credit unions participate in shared ATM networks, which provide access to thousands of ATMs without additional fees.

Minimum Balance Requirements

Some checking accounts require you to maintain a minimum balance to remain fee-free. If your balance falls below the minimum, you may be charged a fee, typically ranging from $5 to $15.

How to Avoid or Minimize Fees

- Choose a bank that offers a free checking account with no minimum balance requirement or one that waives the monthly fee with direct deposit.

- Maintain enough money in your account to avoid overdraft fees and meet the required account balance.

- Use in-network ATMs or seek banks that reimburse out-of-network ATM fees.

- Opt for overdraft protection, but be aware of any associated fees.

Savings Account

Savings accounts are designed for storing funds over time and earn interest on your deposits.

Common Savings Account Fees

Savings accounts may have fees that are typically lower than checking accounts, but understanding these fees can help you avoid extra costs.

Monthly Maintenance Fees

Similar to checking accounts, savings accounts may also have monthly fees. However, these fees are often lower, ranging from $2 to $10 per month. The fee may be waived if you maintain a minimum balance or set up automatic transfers from a linked checking account.

Excess Withdrawal Fee

Exceeding the limit of six withdrawals or transfers per month may result in an excess withdrawal fee, usually around $5 to $15 per transaction. Repeatedly exceeding this limit could lead to account closure or conversion to a checking account.

Minimum Balance Requirements

Some savings accounts require a minimum balance to avoid fees or earn interest. Falling below the minimum may result in a fee or reduced interest rates. These requirements can vary, with some accounts requiring as little as $25, while others may require $100 or more.

How to Avoid or Minimize Fees

- Choose a bank or credit union that offers free savings accounts and has no minimum deposit requirements.

- Monitor your withdrawal frequency to avoid excess withdrawal fees. Use a checking account for more frequent transactions.

- Maintain the required account balance to avoid charges and earn interest.

Money Market Account

Money market accounts combine features of both checking and savings accounts. They offer higher interest rates than regular checking or savings accounts and allow limited check-writing and debit card use.

Common Money Market Account Fees

These accounts often come with a few specific fees, which vary by bank and account type.

Monthly Maintenance Fee

Money market accounts may have monthly maintenance fees ranging from $5 to $15, similar to checking accounts. The fee may be waived if you meet balance requirements or set up automatic transfers from a linked checking account.

Minimum Balance and Deposit Requirements

These accounts often have higher minimum balance and deposit requirements than a checking or savings account, sometimes as high as $1,000 or more. Falling below this balance may result in a fee or a reduced interest rate.

How to Avoid or Minimize Fees

- Shop around for a financial institution that offers low-fee or no-fee money market accounts.

- Maintain the required minimum balance to avoid fees and earn interest.

- Set up automatic transfers to help you maintain the required account balance.

Certificate of Deposit (CD)

A certificate of deposit is a time-based account where you agree to leave a set amount of money for a specific term, often earning a higher interest rate than standard savings accounts. CD terms range from a few months to several years.

Common CD Fees

CDs have fewer fees than other accounts, but early withdrawal penalties are a key consideration.

Early Withdrawal Penalty

Withdrawing funds from a CD before its maturity date will often result in an early withdrawal penalty. This penalty may be calculated as a percentage of the amount withdrawn or as a certain number of months’ worth of interest. The penalty can be quite substantial, sometimes erasing all the interest earned on the CD.

How to Avoid or Minimize Fees

- Choose a CD term that aligns with your financial goals and needs to avoid the need for early withdrawals. Consider using a CD ladder strategy, which involves investing in multiple CDs with varying terms to provide more frequent access to funds.

- Compare CD rates and terms across different financial institutions to find the best fit.

Factors That Affect Bank Account Costs

These include the type of financial institution, your banking habits, and any current promotions or special offers available.

Bank Size and Type

The size and type of bank you choose can play a big role in the fees you encounter and the overall experience you’ll have with your account. Here’s a closer look at the differences between traditional banks, credit unions, and online banks.

Traditional Banks

Traditional banks, such as national and regional banks, may have higher fees due to their extensive branch networks and operational costs. However, they often provide a wide range of services and products, including personal loans, mortgages, and credit cards.

Credit Unions

Local credit unions are member-owned, not-for-profit financial institutions that typically offer lower fees and higher yields on deposits. They may also offer more personalized customer service and a sense of community. However, they may have fewer branches and limited product offerings compared to traditional banks.

Online Banks

Online banks, which operate without physical branches, generally have lower overhead costs, allowing them to offer lower fees and higher rates. They often provide a user-friendly mobile banking experience but may have limited customer service options, such as no in-person assistance.

See also: Are Online Banks Safe?

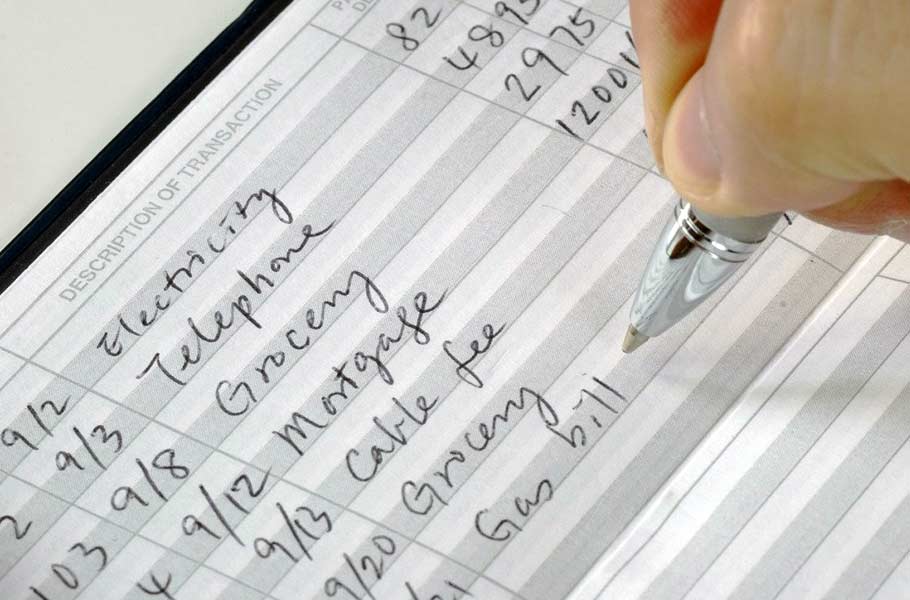

Customer’s Financial Habits

Your financial habits can significantly impact the cost of maintaining a bank account. Maintaining minimum balances, using in-network ATMs, and setting up direct deposit can help you avoid or minimize fees. Additionally, monitoring your spending and keeping track of your account activity can help you identify and address potential issues before they result in fees or penalties.

Bank Promotions and Offers

Some financial institutions may waive fees or offer sign-up bonuses to attract new account holders. These bonuses can range from cash rewards to promotional interest rates or waived fees for a certain period. Taking advantage of these promotions can help reduce the cost of opening and maintaining a bank account, but it’s essential to read the fine print and understand any requirements or limitations associated with the promotion.

Tips for Choosing the Right Bank and Account for Your Needs

Finding a bank that aligns with your needs can improve your financial experience. Here are some practical tips for selecting the right bank and account.

Look Into Different Bank Account Options

Start by comparing banks through customer reviews and asking for recommendations from friends or family. This will give you insights into fees, account features, and customer experiences. Choose a bank known for low fees, competitive rates, and solid customer satisfaction.

Evaluate Key Features That Matter to You

Think about the features that make banking easier for you, such as interest rates, ATM accessibility, and digital tools. Ensure the bank has convenient branch and ATM locations, a user-friendly mobile and online banking platform, and accessible customer support when you need it.

Consider Future Needs for Additional Services

If you might need services like credit cards, mortgages, or investment accounts, look into banks that offer competitive rates and terms on these products. Having access to a range of services under one institution can simplify managing your finances.

Bottom Line

Opening a bank account is an essential step in managing your personal finances. By understanding the various types of bank accounts, their associated fees, and strategies for minimizing costs, you can make informed decisions and take control of your financial future. Researching your options, evaluating account features, and considering your financial habits will help you find the right bank and account to meet your needs and maximize your savings potential.